欧元自诞生以来与金价的比值下跌了85%

欧元自诞生以来与金价的比值下跌了85%

译者 王为

文中黑字部分为原文,蓝字部分为译文,红字部分为译者注释或补充说明

Since Inception the Euro Has Devalued by 85% Against Gold

by Jan Nieuwenhuijs

On April 23, 2020, the gold price breached €51,000 euros per Kg for the first time in history. The gold price in euros has increased by 555% since the euro was created in 1999. Put differently, since inception the euro lost 85% of its value against gold.

2020年4月23日,每公斤黄金的欧元报价在历史上首次上破51,000欧元大关,欧元标价的金价自欧元于1999年诞生以来已上涨了555%。换句话说就是,欧元自诞生以来与金价的比价下跌了85%。

Technically, the euro was launched on January 1, 1999, although euro notes and coins started circulating in January of 2002. The first gold price recorded in 1999 was €7,879 euros per Kg—or €7.88 euros per gram . By now, the gold price has crossed €51 euros per gram. A new all-time high.

从技术角度讲,欧元是在1999年1月1日推出的,尽管欧元的纸币和硬币是在2002年1月1日才开始流通。1999年每公斤黄金的欧元标价为7,879欧元,即7.88欧元/克,后文中在谈到黄金的报价时均使用每克黄金等于多少欧元这一标价方法,而现在的金价为51欧元/克,为历史最高位。

Over the course of 20 years, the price of gold in euros has increased by 555%. From a historic perspective the euro is a young currency, but already lost 85% of its value against gold. This reveals the instability of fiat money.

欧元标价的金价在过去20年中上涨了555%,从历史的角度来看欧元还是个年轻的货币,但与金价的比值已经跌去85%,彰显了作为法定货币的纸币币值的不稳定性。

To evaluate by how much the euro has devalued against gold, it must be measured in gold terms . In 1999 it took 0.13 gram to buy one euro; today only 0.02 gram. The result is that the euro lost 85% of its value versus gold. In the chart below you can see the euro’s descent versus gold since 1999.

为了搞清楚欧元的价值相对于金价贬值了多少,必须以金价作为衡量单位,因为一个货币的价值不可能贬值100%。在1999年1欧元等价0.13克黄金,而今天只能买到0.02克,结果就是欧元的价值相对于金价跌去了85%。在下图中,可以看到1999年以来欧元相对于金价的下跌走势。

Measuring the value of currencies against each other is interesting, but most important is what this means for the purchasing power of currencies locally. The end goal of every participant in the economy is goods and services. What truly matters for a currency is its purchasing power. We will compare the purchasing power of euros versus gold in the eurozone.

比较各个货币之间的汇率是趣事一桩,但最重要的是对于被比较的货币在本国国内的购买力来讲有何意义。每一个参与经济运行的人的最终目的就是获得商品和服务,一个货币真正重要的地方在于其购买力,我们要比较的就是欧元和黄金在欧元区的购买力。

Many people think that euros only lose purchasing power when a bank needs to be paid to store the euros. In other words, if the interest rate on a bank account is negative. This is called “the money illusion.” In reality, one has to subtract consumer price inflation from the interest rate, to arrive at the real interest rate. For the sake of simplicity, let‘s say the current interest rate for most savers is zero, minus one percent inflation, is -1%. Currently, euros approximately lose 1% of their purchasing power per year.

很多人认为,当欧元区的商业银行需要为欧元存款支付利息只会导致欧元的购买力遭受到损失。换句话说就是,如果欧元区的银行存款是以负利率计息,这种现象被称为“货币幻觉”。实际上,应该从名义利率中将以消费物价增幅为代表的通货膨胀率剥离出去,剩下的才是实际的利率水平。为简单起见,假设大多数存款者当前享受的存款利率为0%,减去一个百分点的通胀率,就是-1%。也就是说,当前欧元的购买力每年都会损失掉差不多1%。

“货币幻觉”一词是美国经济学家欧文·费雪于1928年提出来的,是货币政策的通货膨胀效应。是指人们只是对货币的名义价值做出反应,而忽视其实际购买力变化的一种心理错觉。他告诉人们,理财的时候不应该只把眼睛盯在哪种商品价格降或是升了,花的钱多了还是少了,而应把大脑用在研究“钱”的购买力、“钱”的潜在价值还有哪些等方面,只有这样,才能真正做到精打细算,花多少钱办多少事。否则,在“货币幻觉”的影响下,“如意算盘”打到最后却发现自己其实是吃亏了。

2019年11月23日我在推特上说过这么一段话,

A friend just told me his bank account might be charged with “negative interest rates” in the future. Outraged he was. I told him inflation was eating away his money for years now, with interest rates at zero. It seemed he didn’t “want” to understand this is the same thing.

— Jan Nieuwenhuijs November 23, 2019

“一位朋友最近跟我说,他的银行存款账户未来可能会被使用负利率。为此,我的这位朋友怒不可遏。我告诉他,零利率政策施行了这么多年,他的存款已经被通货膨胀吃掉了很多,但他似乎并不想承认这其实是一回事。”

Now, let’s have a look at gold. Over the past 12 months the gold price has increased by 39%. Subtracted by 1% inflation, is 38%. In one year the purchasing power of gold has increased by 38% in the eurozone . However, the gold price doesn’t go up by 39% every year, it can even go down for some years. Nevertheless, gold’s purchasing power has greatly increased over the past 20 years. Which is why physical gold should be seen as a long-term reserve asset.

现在来看金价的走势。在过去十二个月里,欧元标价的金价上涨了39%,去掉1%的通胀率等于38%,黄金在欧元区的购买力在一年里涨了38%。但金价不可能每年都上涨39%,在有些年份里甚至还会下跌。不管怎样,黄金的购买力在过去二十年里还是出现了大幅增长,这就是实物黄金应被视为一种长期储备资产的原因。

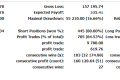

To reveal gold’s purchasing power in the eurozone I have adopted an index. First, I divided the gold price by consumer prices, and then created an index with a base of 100 in the year 1999. I have computed gold’s purchasing power index for Finland, Germany and Italy. Because consumer prices slightly differ for the selected countries, the purchasing power of gold in these countries is not exactly equal. Though, I found gold‘s purchasing power is roughly the same for the entire eurozone.

为揭示出黄金在欧元区的购买力变化,我编制了一个指数。我先用金价除以消费物价指数,然后以1999年作为统计基期,将1999年的数值定义为100,这样就形成了一个欧元金价购买力指数,我用该办法统计了黄金在芬兰、德国和意大利这三国的购买力变化情况。因各国的消费物价涨幅略有不同,黄金在这几个国家中的购买力也不尽相同。尽管如此,黄金在整个欧元区的购买力变化趋势还是基本一致的。

First and foremost, you can see gold’s purchasing power has increased in the eurozone since 1999. This means that the price of gold has outpaced consumer prices. From the index number you can see that gold’s purchasing power, on average, has increased by a staggering 350% over 20 years. The gold price can be volatile, at times, but over longer periods of time it preserves its purchasing power, with the benefit that it doesn’t have any counterparty risk, so it withstands every crisis.

首先可以在图中看到,自1999年以来黄金在欧元区的购买力一直在上升,这就意味着金价的涨幅超过了欧元区的消费物价增幅。指数的数值变化显示黄金在这几个欧元区国家的购买力过去20年的平均涨幅达到了惊人的350%,1999年的数值为100,而最新值为450。金价在有的时期波动很剧烈,但长期来看还是保持住了其购买力,而且黄金还有一个优点——没有任何交易对手风险,这就是黄金能挺过一场又一场经济危机的原因。

本文地址:http://www.ea666.cn/currency/eur/145668.html